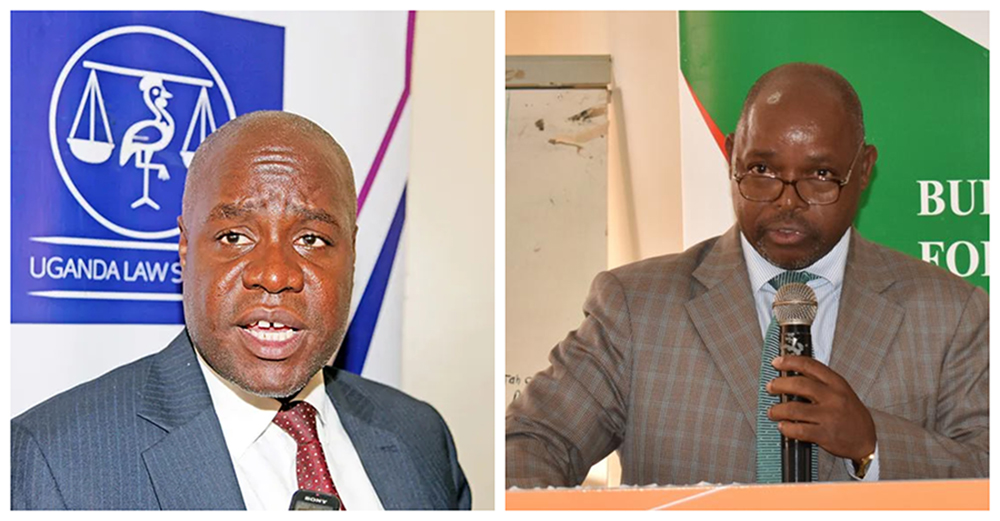

Timothy Kayondo and Denis Muguzi have lost their piece of land after they defaulted on a Shs 200 million loan offered to them by Goldmine Finance Limited. The loan was offered at a rate of 48% per year.

Justice Susan Odongo of the High Court overturned a lower court’s temporary injunction that had blocked the sale of a mortgaged property.

On July 22, 2022, Kayondo and Muguzi signed a loan agreement with Goldmine Finances. The pair borrowed Shs 200 million at a fixed interest rate of 4% per month, repayable over 12 months.

They offered land in Busiro Block 306, Plot 7629 at Bira, jointly owned by them as security. Kayondo and Muguzi defaulted on repayments, paying back only Shs 33 million, far short of the principal and interest owed.

Goldmine then exercised its right as mortgagee to sell the property at a public auction. It was bought by Richard Kakonge, and the title was transferred to him on 26 February 2024.

Unhappy with the sale, Kayondo and Muguzi filed a suit against Goldmine, Kakonge, and the commissioner for Land Registration. They claimed the loan contract was illegal, the interest rates harsh and excessive, the mortgages unenforceable, and the sale fraudulent due to a lack of proper process.

They also accused the land commissioner of wrongly removing a government caveat to enable the transfer. Alongside the main suit, the borrowers sought and obtained a temporary injunction in 2024, which stopped Goldmine and Kakonge from interfering with their possession of the property.

Goldmine appealed this injunction, arguing it was wrongly granted. The appeal focused on several procedural and substantive points:

First, Goldmine claimed the borrowers’ supporting affidavit was invalid because it was sworn by only one borrower without written authority from the other. They also argued that adding Kakonge as a defendant and amending the lawsuit twice without court permission broke civil procedure rules.

Secondly, Goldmine argued, Kayondo and Muguzi did not initially express any unfairness of the interest rate, which was 48% per year in addition to 0.5% daily penalties on arrears.

Thirdly, the financial firm wanted to know who would suffer more without the injunction? The lower court favoured the borrowers to maintain the “status quo” – them in possession while Kakonge held the title. Goldmine argued the balance tipped towards the buyer, who now has legal ownership.

Justice Odongo dismissed the procedural objections as lacking “practical utility,” noting no real harm was caused. However, on the core issues, she found no strong prima facie case for the borrowers, as the loan terms appeared freely agreed and the sale followed mortgage laws.

Ssemugenyi received Shs 80 bn on his account. Gov’t suspected fraud. It wasn’t the case

She ruled that any harm could be compensated financially and that allowing the borrowers to stay would unfairly benefit them at the expense of the legitimate buyer.

For Goldmine Finance, this is a win that upholds their right to recover debts without court interference in straightforward loan defaults. For the borrowers, Kayondo and Muguzi, the ruling lifts the temporary shield, meaning they could soon lose physical control of the property. Kakonge, the buyer, can now proceed with handover and possession.

However, this does not end the main lawsuit because the borrowers can still pursue their claims of fraud and unfair terms in another suit they filed in 2024. If they win that, they might get the sale overturned or compensation, but they will need to have stronger evidence.