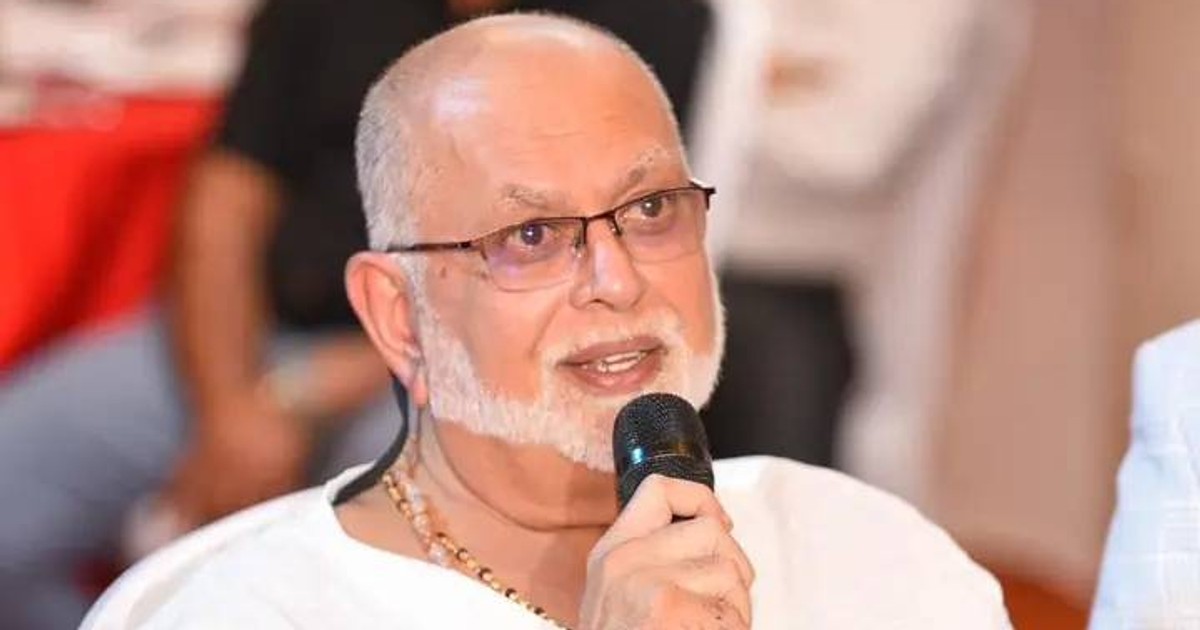

Mohanpal Singh Bharj, a Kampala-based businessman, has won a legal battle against his former tax adviser, Hitesh Mahendra Mehta, whom he had lent Shs 270 million.

The case, heard in the Commercial Division of the High Court, stemmed from a financial arrangement gone sour between the two men, both chartered accountants.

The disagreement began in late 2020 when Bharj transferred Shs 270 million to Mehta in six instalments between November 13, 2020 and December 9, 2020. Bharj claimed this was a friendly loan, based on mutual trust, to be repaid within 12 months.

He said Mehta had requested the money personally.

Mehta, however, denied that any loan existed. He argued that the money was part payment for tax advisory services he provided to Bharj through his firm, Nexia HMS Associates. According to Mehta, the total fee agreed upon was Shs 550 million, leaving a balance of Shs 280 million unpaid. He filed a counterclaim demanding this outstanding amount, plus aggravated damages.

The pair’s professional relationship started earlier that year. In August 2020, Bharj was introduced to Mehta by a mutual friend to handle tax matters with the Uganda Revenue Authority. Emails showed they later agreed on a separate fee of Shs 35 million, for specific tax work, which Bharj paid directly into the firm’s account. But the larger sum went into Mehta’s personal account, which became a key point in the case.

Bharj filed the lawsuit in 2024 after repeated demands for repayment went unanswered, including a formal letter from his lawyers in April 2023.

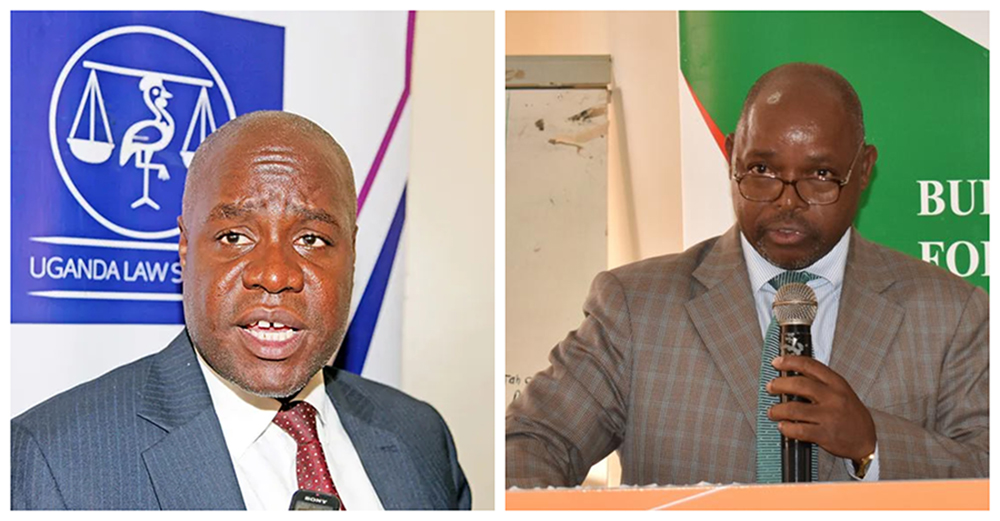

The court, presided over by Justice Patience Rubagumya, addressed four main issues:

- Was there a friendly loan agreement? The judge ruled yes. Despite no written contract, which Ugandan law requires for deals over Shs500,000, the court found the oral agreement valid. Bank statements and emails proved the Shs 270 million was separate from the tax fees. The judge noted that oral contracts can be enforced if there’s clear evidence of intent and partial performance, as in this case where the money was transferred.

- Did Mehta breach the agreement? Yes, the court said. By failing to repay the loan despite reminders, Mehta violated the terms.

- Is Bharj liable for Shs 280 million counterclaim? No. The judge dismissed Mehta’s claim, finding no evidence of an agreement for Shs 550 million in fees. The only proven professional fee was the Shs 35 million, which had been paid.

- What remedies are available? The court awarded Bharj the full loan amount, plus Shs 20 million in general damages for the inconvenience and loss caused by the non-repayment. Interest was set at 10% per year on the loan from the date the suit was filed, and 6% on the damages from the judgement date. Bharj also gets his legal costs covered.

The ruling emphasised that “friendly loans” are legitimate financial agreements based on trust between acquaintances, but they must still meet basic contract rules like clear terms and intent.

The court recognised the “mutual trust” between the two professionals, but stressed that Mehta’s refusal to repay caused unnecessary hardship. This could restore Bharj’s funds and set a precedent for enforcing informal loans in business circles.

Justice Rubagumya criticised Mehta’s explanation for depositing the money in his personal account (to avoid taxes until full payment), noting it was unusual for professional fees. She said this could damage his reputation as a tax adviser, especially since the court found his version less credible.