The Uganda Investment Authority (UIA) and the Bank of Uganda have called for increased up take of affordable financing by small businesses and commercial farmers.

They made the call during a workshop for SMEs in Rukungiri.

The workshop focused on the central bank’s two financing facilities: the Small Business Recovery Fund (SBRF) which targets micro, small and medium enterprises’ recovery from the adverse effects of the Covid pandemic, and the Agricultural Credit Facility (ACF) that targets commercial farmers.

The deputy governor of Bank of Uganda, Dr. Michael Atingi-Ego, in a speech read for him by the Executive Director Finance, Richard Byarugaba, said although small businesses are key to Uganda’s economic growth, their major constraint is access to affordable credit, hence the creation of the two funds – SBRF and ACF.

He said the Agricultural Credit Facility, totaling Shs 800 billion, is for MSMEs to acquire equipment for farming, post-harvest handling & value addition, amongst others.

The fund is accessed through Bank of Uganda-supervised financial institutions up to the tune of Shs 2.1 billion repayable in eight years (maximum), with a grace period of three years (maximum) and an interest rate of 12 percent per annum.

The SBRF, worth Shs 200 billion, provides affordable financial loans to small enterprises that have experienced hardships due to the measures undertaken to control the spread of the coronavirus in Uganda.

Eligibility is for small businesses operated by individuals, groups, partnerships, and companies, employing between 2-49 people and with an annual turnover of Shs 10 million to Shs 300 million. with demonstrable capacity for recovery.

Jim Muhwezi, the minister of Security who presided over the workshop, hailed UIA and Bank of Uganda for taking awareness on affordable funding to the people of Rukungiri whom he urged to access the money, invest wisely and boost their businesses.

The Chairman of Uganda Investment Authority, Morrison Rwakakamba, said the workshop on access to affordable financing is an eye opener to the business community and farmers in Uganda on funding opportunities offered by the government.

“Rukungiri is strategically located near eastern Democratic Republic of Congo and has enabling infrastructure like roads and electricity. These are opportunities and enablers that the business and farming communities should seize and exploit for investment and business”, said Rwakakamba.

The Rukungiri district Chairman, Geoffrey Kyomukama, urged the people to use the funds to boost commercial farming by investing in things like irrigation schemes, post-harvest handling, cold storage facilities, and transportation of produce, amongst others.

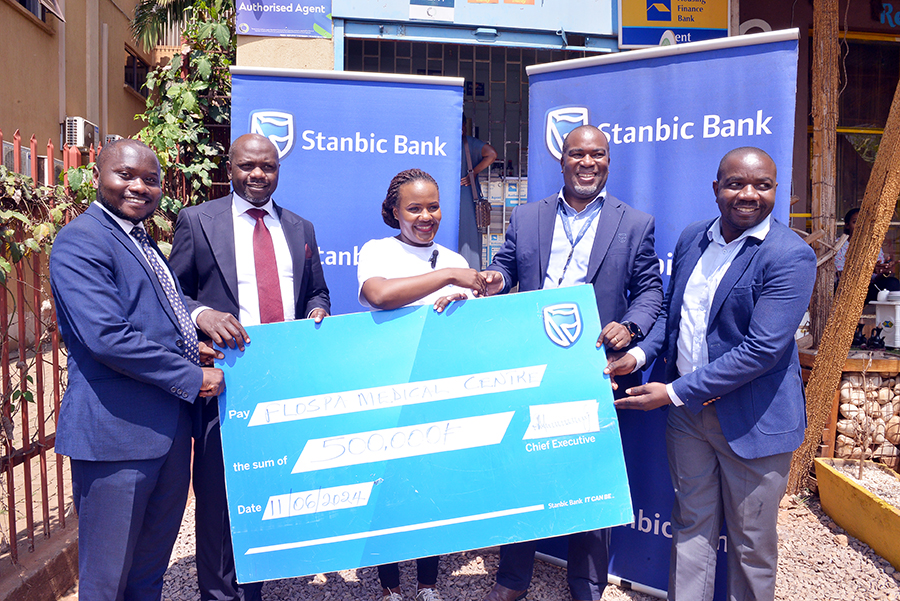

Representatives of banks like Stanbic, Centenary, Post, Equity and Pride Microfinance fielded questions from the participants on various financing issues.

The access to affordable financing workshops, already also held in Arua and Mbarara, are being rolled out to other parts of Uganda in an attempt to increase uptake of the central bank-managed funds.