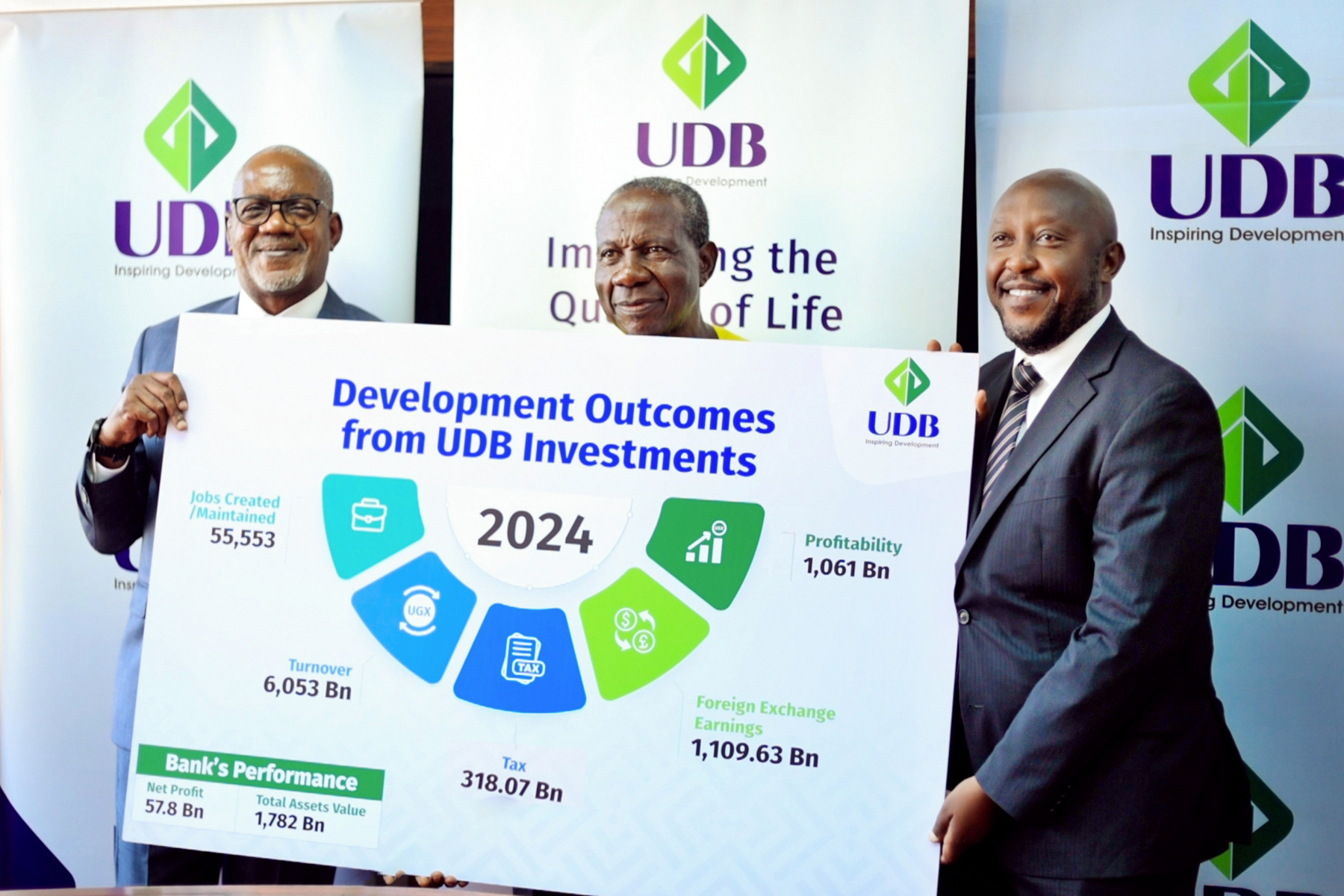

Uganda Development Bank(UDB) announced a robust performance for 2024 registering a profit of Shs 57.8 billion. This marks a 16% increase from Shs 49.8 billion in 2023.

During the release of the bank’s performance report yesterday, Dr. Patricia Ojangole, UDB’s managing director, emphasized the bank’s focus on resource efficiency and innovative funding to enhance its development impact.

She said UDB had received multiple awards in 2024, including Regional Bank of the Year – East Africa at the African Banker Awards and Sustainability Leader of the Year at the Karlsruhe Sustainability Awards for the fourth consecutive year. Fitch Ratings assigned a ‘AA+ (Uga)’ National Long-term Rating with a Stable Outlook.

Accoding to the results, UDB’s total assets grew by 7% to Shs 1.78 trillion from Shs 1.67 trillion, supported by government capital injections and retained earnings.

The bank’s loan portfolio expanded by 9%, with net loans rising from Shs 1.47 trillion to Shs 1.53 trillion. UDB approved Shs 454 billion in new loans to over 170 enterprises across 67 districts, expected to generate 17,832 jobs, Shs 9.7 trillion in output, Shs 1.8 trillion in foreign exchange earnings, Shs 1.7 trillion in profits, and Shs 455 billion in taxes.

The Bank disbursed Shs 388 billion to 770 projects across 103 districts, with 50% of investments in the industrial sector, 46.8% in agro-industrialization, and 3.2% in mineral-based industries.

The bank reinvested Shs 437 billion from loan repayments and received Shs 80.7 billion in additional government capital, increasing total capitalization to Shs 1.46 trillion from UGX 1.32 trillion. The Bank’s initiatives included the Business Accelerator for Successful Entrepreneurs (BASE), training 450 entities, particularly youth and women, and incubating 71 early-stage businesses.

UDB also allocated Shs 5.1 billion to transform high-potential agricultural projects into bankable ventures and supported 42,000 households and small businesses through a Hybrid electricity connections program.

According to the report, Enterprises backed by UDB created and sustained 55,553 jobs in 2024, up 7.2% from 51,841 in 2023, with 59.9% held by youth and 31.3% by women. Annual output from these enterprises rose 3.2% to Shs 6.05 trillion, tax contributions increased to Shs 316 billion from Shs 236 billion, and foreign exchange earnings grew 17% to Shs 1.1 trillion.

At the meeting, Matia Kasaija, the minister of Finance, praised UDB’s alignment with the National Development Plan and Vision 2040, while board chairman Geoffrey Kihuguru underscored the Bank’s commitment to operational efficiency and sustainability.