Stanbic Bank Uganda has been named Best Bank and Best Investment Bank in Uganda at the 2025 Euromoney Awards for Excellence, solidifying its position as the country’s leading financial institution.

These prestigious awards highlight the bank’s dominance in retail, commercial, and corporate banking, and its pivotal role in advancing Uganda’s economic transformation.

The Euromoney Awards, a global benchmark in banking, recognize institutions for exceptional financial performance, client service, digital innovation, and societal impact.

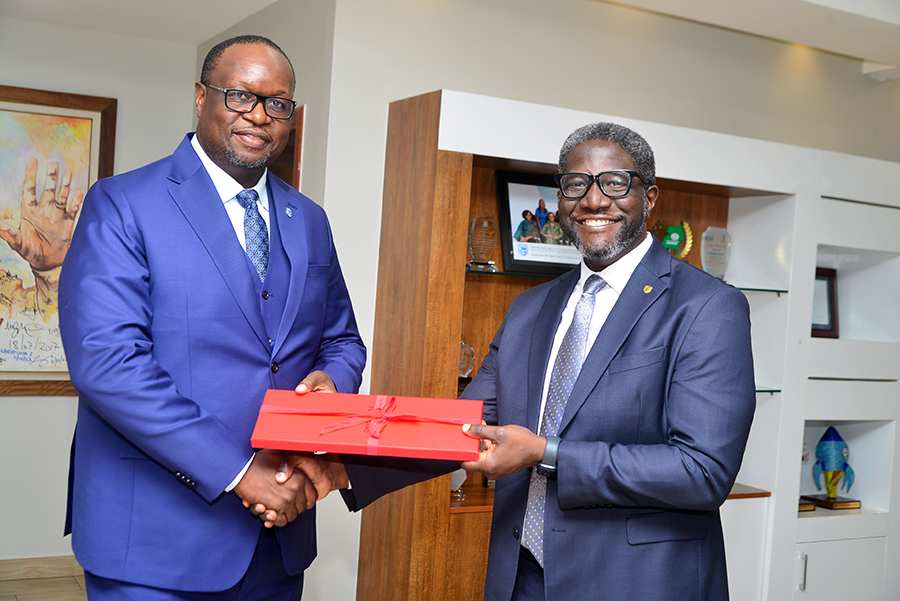

“These awards affirm our strategy to drive sustainable value by financing Uganda’s growth,” said Paul Muganwa, Executive Director and Head of Corporate and Investment Banking at Stanbic Bank Uganda.

“We’re proud to mobilize capital, structure complex deals, and support businesses shaping Uganda’s future.”

Unmatched Excellence

In 2024, Stanbic Bank Uganda achieved a profit after tax of Shs 478 billion ($133 million), up 16.2% year-on-year, with a return on equity of 24.3%. The bank improved operational efficiency, reducing its cost-to-income ratio to 47.2%, while maintaining a credit loss ratio of just 0.8%.

“Our disciplined execution and client-focused innovation set us apart,” said Daniel Ogong, Head of Brand and Marketing.

“These awards validate our efforts to reimagine banking as a platform for inclusion, empowerment, and progress.”

Stanbic’s digital transformation has been key, with 80% of transactions now conducted outside branches, supported by upgraded platforms like online account opening and a real-time customer feedback tool achieving over 92% first-call resolution.

Inclusive Growth and Innovation

In investment banking, the bank facilitated major transactions, including a $30 million loan to Crown Beverages Limited for expansion and a Shs 370 billion facility to MTN Uganda, one of the country’s largest single-lender deals. It also led a landmark secondary equity offering for MTN Uganda, pricing over 1.57 billion shares at Shs 170 each, boosting market liquidity and investor access.

Through its partnership with fintech innovator Jumo, Stanbic enabled Shs 56.9 billion ($15.9 million) in mobile microloans, expanding financial inclusion for thousands of unbanked Ugandans.

Empowering Entrepreneurs

Stanbic’s commitment to inclusive growth extends to supporting entrepreneurs. In 2024, the Stanbic Business Incubator trained and mentored over 3,000 entrepreneurs, many of them women and youth, and unlocked over $20 million in financing for MSMEs, addressing critical capital gaps.

The bank also launched the Stanbic Unit Trust under SBG Securities Uganda, offering retail wealth management to everyday Ugandans, democratizing investment and fostering long-term wealth creation.

“These awards reflect more than financial success,” said Mr. Muganwa. “They affirm our purpose: fueling Uganda’s growth, from smallholder farmers to multinational corporations.”

As Uganda advances in infrastructure, energy, agriculture, and digital transformation, Stanbic Bank Uganda remains at the forefront.

“We’re not just winning awards; we’re building a future where every Ugandan has access to financial opportunity,” said Mr. Ogong.

“This is Stanbic’s excellence: performance with purpose.”