Pharmaceutical distributors and importers in Uganda have threatened to cease operations if the National Drug Authority (NDA) does not revise the newly imposed 17% tax on imported drugs.

Effective this month, the tax has increased from the previous 12% to 17%, a move described by industry stakeholders as exorbitant and unfair. They argue that it not only jeopardizes their businesses but also disregards the welfare of the public.

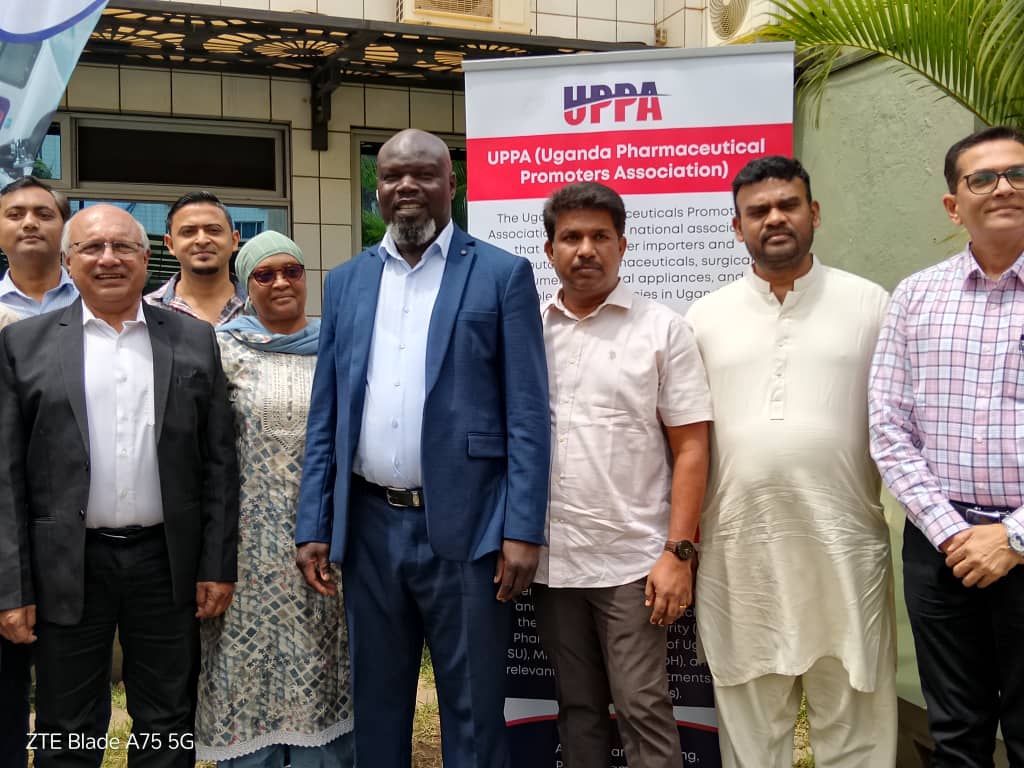

Kirti Shah, chairman of the Uganda Pharmaceutical Promoters Association (UPPA), expressed profound dissatisfaction with the steep tax increase. He issued a one-week ultimatum to the ministry of Health to address their concerns, warning of potential industry action if the matter remains unresolved.

“The NDA must recognise that excessive taxation on drugs affects not only businesses but also the wider population. By increasing costs, this policy risks denying people access to essential medicines, contravening the World Health Organization’s mandate for nations to ensure their citizens have access to affordable drugs and quality healthcare,” Shah said.

Dr Hussein Oria, Secretary of the UPPA, echoed these sentiments, warning that continued imposition of such taxes could force distributors to close their centres nationwide.

“We are deeply disappointed with these taxes. While the government may aim to promote locally manufactured drugs, Uganda lacks the capacity to produce all necessary medicines and health equipment. In contrast, Kenya, a regional leader in pharmaceutical manufacturing, supports its importers with incentives, unlike Uganda,” he said.

The UPPA urged the ministry of Health and the NDA to reconsider the tax policy to safeguard both the pharmaceutical industry and public access to essential medicines.