Prominent law firm Muwema & Co. Advocates has said it will appeal a High Court ruling that ordered it to pay more than Shs 1.3 billion ($370,000) in rent arrears to Downtown Investments Limited regarding its premises on Windsor Crescent in Kololo.

The judgment, delivered on February 20 by Justice Patricia Mutesi, arose from a dispute between Downtown Investments Limited and the law firm over rental obligations and an attempted purchase of the property.

Paresh Kumar Ratilal Mehta, a businessman of Indian origin, is a director in Downtown Investments.

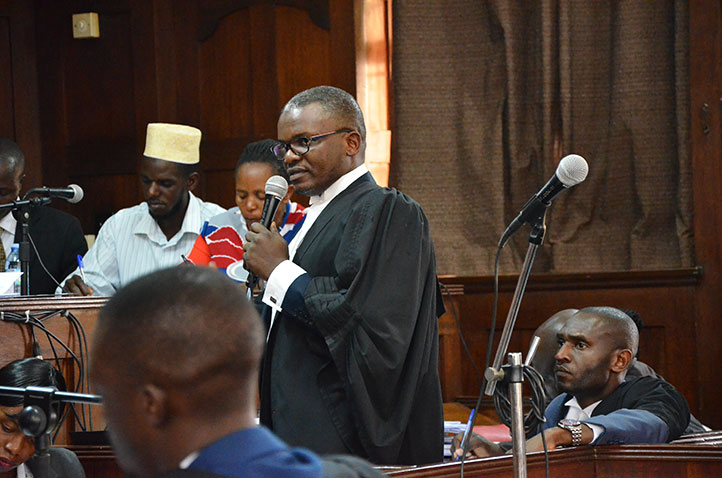

In a statement, the firm, managed by Fred Muwema, a respected lawyer, said recent media reports had sensationalised the ruling “without providing adequate context, causing concern among its clients and partners.”

The dispute stems from a five-year renewable lease agreement signed in 2016 for an old building at the Kololo address. At the time, the agreed rent was Shs 19 million per month, subject to revision.

The lease agreement included a clause granting the tenant first option to purchase the property at a price of Shs 7 billion ($2 million) if the purchase was concluded within 12 months of commencement of the lease. After the first year, the agreement provided that the sale price would be determined by the market.

While the firm did not exercise the option within the first 12 months, it maintains that the right to purchase remained in force.

“Our right to purchase the property, which we had acquired under the lease, remained available. The only difference was that the price would be determined by the market after the 12 months,” the firm said.

On August 2, 2021, the firm says it formally exercised its option to purchase the property and offered Shs 3.7 billion ($ 1.05 million), which was equivalent to Shs 61 million per decimal for the approximately 60 decimal plot.

“The average rate per decimal in that area at the time was between $ 15,000 and $20,000 per decimal,” the firm claimed. This would be equivalent to between Shs 53 million and Shs 71 million per decimal.

According to court records, Downtown Investments reportedly rejected the offer as being below its expectations but did not make a formal counteroffer or enter negotiations to determine a market price.

The law firm argues that instead of negotiating, Downtown increased rent to Shs 39 million per month and began demanding payment of what it described as rent arrears.

By May 2023, Downtown claimed Shs 532 million in unpaid rent and filed a suit seeking recovery of the arrears, mesne profits, and vacant possession of the premises.

In its defence, the firm contended that it had already exercised its right to purchase and that the landlord should have proceeded to conclude the sale.

The firm further stated that during court-mediated proceedings, it paid Shs 466 million toward the claimed arrears in the hope that negotiations would proceed.

Despite this, the court entered judgment in favour of Downtown Investments.

The firm says it is dissatisfied with the decision and will challenge it in the Court of Appeal.

Among the grounds of appeal, the firm argues that Justice Mutesi failed to consider evidence showing payment of Shs 466 million toward the rent arrears.

“The trial judge erred in law and fact by finding that we did not enjoy the right to purchase the property despite exercising our option to purchase it,” the firm stated.