On Kampala Road, next to Crane Chambers, stands the gleaming Church House, a 16-story building that serves as the headquarters for the Church of Uganda.

This iconic structure, completed in recent years, nearly slipped from the church’s grasp due to a massive loan from Equity Bank Uganda. Back in 2010, under the leadership of then Archbishop Henry Luke Orombi, the Church of Uganda borrowed about Shs40 billion from Equity Bank to fund the construction of Church House.

The loan was meant to turn the Church’s long-held dream, first planned in the 1960s, into reality, providing office spaces and generating rental income for the church’s operations.

However, as the years passed, repayment became a heavy burden. By 2024, the outstanding debt had ballooned to over Shs60 billion due to interest and delays.

Equity Bank, holding the land title as collateral, threatened to seize and sell the property if the church defaulted fully. Church leaders scrambled, appealing to congregants and partners for funds. The situation grew tense, with fears that the church’s prime asset could be auctioned off, leaving the institution without its spiritual and administrative hub.

Archbishop Stephen Kaziimba Mugalu described it as a “miracle” when the final payment was made in June 2024, clearing the debt and allowing Equity Bank to hand back the land title during the Church of Uganda’s Provincial Assembly in August 2024.

This close call highlighted Equity Bank’s strict approach to loan recovery, sparking widespread concern among some Ugandan borrowers. While the church escaped unscathed, several businesspeople have not been so lucky. Some are facing court battles that have put their businesses and properties on the line. Others have lost their properties altogether.

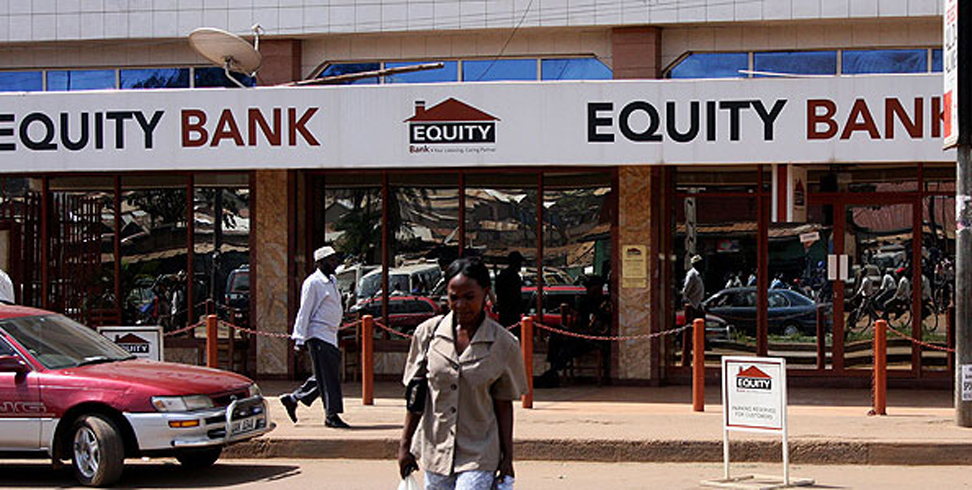

Equity Bank Uganda, part of the larger Equity Group Holdings, has grown rapidly in East Africa by offering loans to small and medium enterprises, farmers, and institutions.

But its aggressive recovery tactics, often involving quick foreclosures and property sales, have earned it a reputation as a “ruthless lender.” Borrowers who default, whether due to economic hardships, poor business decisions, or disputes over loan terms, find themselves in lengthy court fights.

These cases often end with Equity Bank winning the right to sell collateral, leaving businesspeople bankrupt and sleepless.

Some critics have argued the bank prioritizes profits over empathy, especially in a country like Uganda, where economic shocks from the Covid-19 pandemic are still reverberating.

But financial experts, however, say strict enforcement is necessary to protect depositors’ money and maintain financial stability.

The cases

One of the most high-profile court cases involves Simbamanyo Estates Limited, owned by the late architect Peter Kamya. In 2012, Simbamanyo secured a $6 million syndicated loan from Equity Bank Uganda and Equity Bank Kenya to finance property developments.

This was later increased to $10 million in 2017, with properties like Simbamanyo House on Lumumba Avenue and Afrique Suites in Mutungo Hill serving as collateral. When Simbamanyo defaulted on repayments, citing issues like unlicensed cross-border lending by Equity Bank Kenya, the bank moved to sell the assets.

Simbamanyo accused the banks of fraud and illegal operations in Uganda. However, in a landmark ruling in July 2022, the High Court dismissed these claims, upholding the loan’s validity. Four months later, Peter Kamya, the brains behind Simbamanyo, died.

High Court: Equity Bank ‘legally’ sold Simbamanyo House to Sudhir

But that was not the end of the issue. Last month, Justice Harriet Magala of the Commercial Division ruled in favour of Equity Bank, affirming the lawful sale of the properties to recover the debt, now exceeding $10 million with interest. Simbamanyo House was sold to tycoon Sudhir Ruparelia for about Shs36 billion, and Afrique Suites followed suit.

Kamya’s family had not only lost their breadwinner, but they also witnessed his multi-billion-dollar empire crumble.

Another ongoing saga putting a business at risk is that of Kennedy Losuk and his company, Emin Pasha Limited. Losuk, a businessman from Karamoja, borrowed around Shs150 billion from Equity Bank Uganda to refurbish the historic Emin Pasha Hotel in Nakasero, Kampala, and fund other construction projects through his firm, Prism Construction.

The loan was secured by prime properties in Kisugu and Nakasero. When Losuk defaulted, blaming delays in government contracts and economic downturns, Equity Bank initiated foreclosure proceedings.

Recently, the High Court upheld the bank’s right to sell the hotel if the outstanding Shs34 billion (a partial settlement amount) isn’t paid by October 10, 2025. President Museveni has reportedly intervened, urging a resolution to save the empire, but the court ruling stands.

Emin Pasha Hotel to be sold on October 10…unless owner clears Shs 34 bn loan

Losuk’s case has drawn attention due to political undertones, with some accusing interference in private banking matters. If the sale proceeds, Losuk could lose the Emin Pasha Hotel, a landmark built in 2005, along with other assets, crippling his business operations and affecting employees.

Smaller fish

Beyond the big names, smaller businesspeople have also faced Equity Bank’s courtroom might.

Take the case of Lydia Achola, a borrower who took a modest Shs 4 million loan from Equity Bank Uganda. Achola defaulted, leading the bank to demand full repayment and threaten seizure of her pledged assets. In 2019, the High Court ruled in favour of the bank, affirming its right to enforce the loan agreement without leniency. While the amount was small compared to others, it illustrates how even everyday entrepreneurs risk losing homes or small businesses over defaults, with courts often siding with the lender’s strict contracts.

Similarly, on May 28, 2020, the bank sued borrower John Buyinza for failing to repay a loan secured by property. The court allowed Equity Bank to proceed with recovery actions, including the potential sale of collateral, which included Buyinza’s house in Makerere. Buyinza argued economic hardships, but the court emphasized the binding nature of the mortgage deed. The bank prevailed, highlighting its no-nonsense policy on defaults.

In another case, Ali Amin Musolo, a businessman based in Kasese Shs 5 million from Uganda Microfinance Limited, a loan that was later taken over by Equity Bank Uganda. But he defaulted, prompting the bank to issue a demand notice and initiate legal proceedings. Musolo’s properties were advertised for sale in the newspapers for sale.

Yet these cases are not isolated. Research shows that loan defaults in Uganda’s banking sector, including at Equity Bank, often stem from high interest rates, sometimes up to 20-25%, combined with borrowers’ financial mismanagement or external factors like inflation and pandemics.

A study on the relationship between interest rates and loan default rates, which used Equity Bank (Nakulabye branch) as a case study, found a direct link between interest rates and default rates, with many clients struggling to keep up.

The researchers, Dr Friday Christopher and Dr Moses Ntirandekura Moses, concluded that higher interest rates increase the likelihood of loan defaults by 65%.

“This suggests that as borrowing costs rise, it becomes more challenging for borrowers to meet repayment obligations, leading to an increased default risk,” they wrote in their paper published in the Metropolitan Journal of Business & Economics in February 2025.

You can read it below:

Business associations like the Uganda Manufacturers Association (UMA) and the Private Sector Foundation Uganda (PSFU) have consistently called for better loan terms and dispute resolution mechanisms by banks.

It is true that Equity Bank, like other financial institutions in Uganda, offers a myriad of opportunities to businesspeople.

Yet for the enterprising and ambitious businessperson, Equity Bank’s courtroom victories show that if you default on your loan, you risk losing everything. From your house to your business, and finally, your livelihood. For many, it’s not just sleepless nights; it’s the end of dreams built on borrowed money.