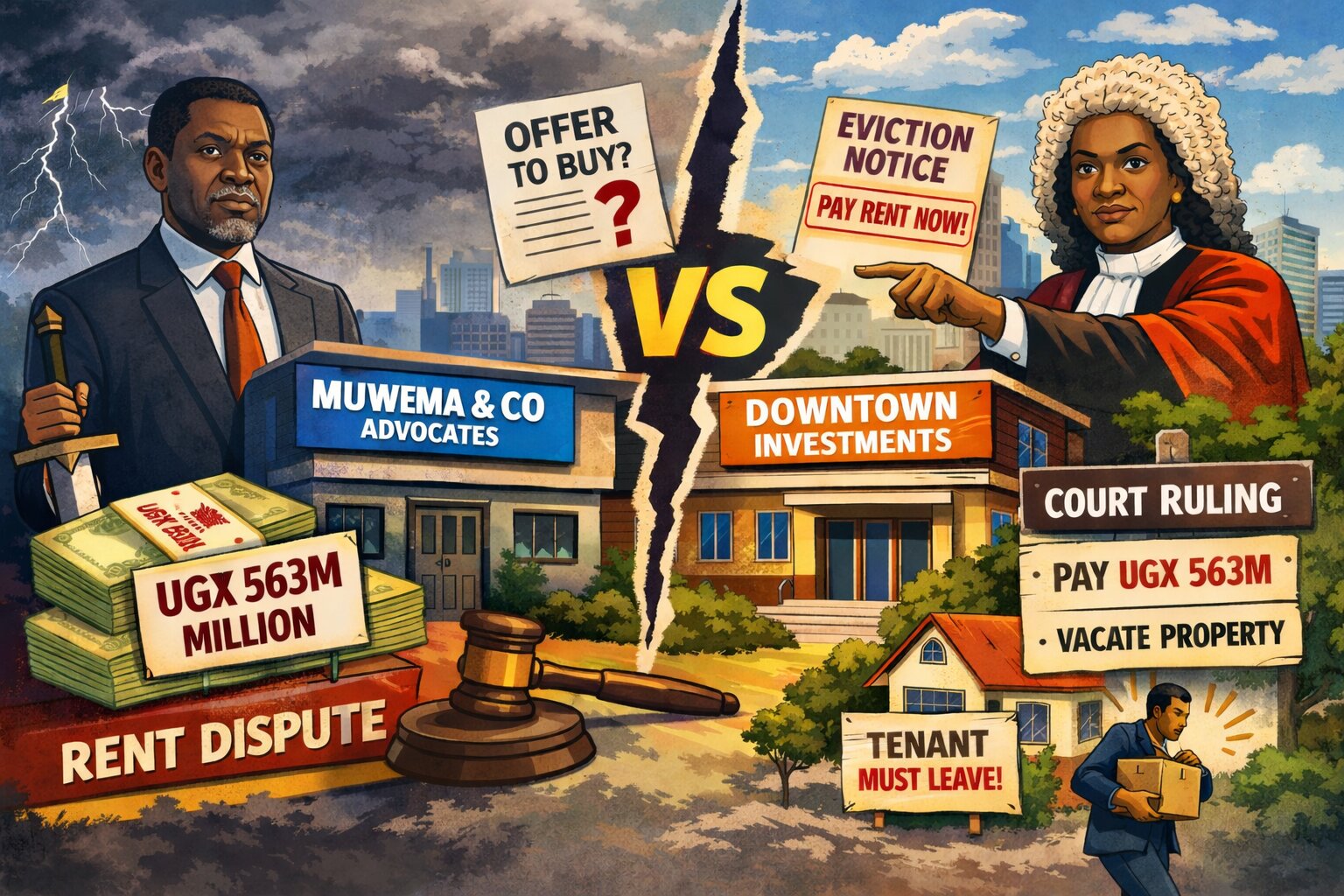

The High Court (Commercial Division) yesterday rejected an application by Ratidu Trading Ltd and two individuals to review and set aside a previous judgment ordering them to pay over Shs 1.3 billion to Equity Bank (U).

Justice Susan Odongo dismissed the case, saying the applicants failed to prove they had discovered new evidence or that their lawyer’s mistake justified reopening the matter.

The case stems from a 2023 lawsuit where Equity Bank sued Ratidu Trading Ltd, along with directors Titi Kayondo Kabi and Asingwire Alex Mukasa, for failing to repay a loan. The bank claimed the outstanding amount was Shs 1.3 billion plus interest and costs.

Kayondo and Mukasa counter arged in another suit that they had already paid more than Shs 700 million toward the debt. However, they provided no proof, such as bank statements, to back this up. The court dismissed their request and ruled in favour of the bank in April this year.

Unhappy with the outcome, they filed another application in the commercial division of the High Court seeking among others to have the judgement reviewed, for a review of the judgement and to halt the seizure of their assets by the bank.

They also wanted an independent auditor to review their bank account to confirm whether or not they had deposited the Shs 700 million.

According to court documents, Kayondo and Mukasa’s main argument was that their previous lawyer negligently forgot to attach bank statements showing the Shs 700 million payment.

They claimed this was “new and important evidence” that was not available earlier due to the oversight, and that blaming them for their lawyer’s mistake would cause “a miscarriage of justice” and financial loss. They attached bank statements from 2018 to 2025 as proof.

Equity Bank strongly opposed the application. In an affidavit by their legal officer Charles Isiko, the bank called it “frivolous” and an abuse of court process. They argued that the bank statements were not new because the applicants, as account holders, had access to them all along.

The bank argued that together with Kayondo and Mukasa, they had reconciled accounts multiple times, including a loan restructure on July 19, 2022, where the applicants agreed the debt was Shs 1.12 billion—after accounting for prior payments.

“No additional Shs 700 million was paid after that date,” the bank argued in court.

Justice Odongo sided with the bank. In her 14-page ruling, she explained that for a court to review a judgment, applicants must show one of three things: a clear error on the record, discovery of truly new evidence, or another strong reason.

Here, the judge said, the bank statements didn’t qualify as new evidence because Kayondo and Mukasa knew about them and could have produced them earlier.

Even reviewing the statements, the judge found no entry for a Shs 700 million payment after the 2022 restructure.

On the lawyer’s alleged negligence, the judge drew a line between honest errors in judgment and actual mistakes. She said not attaching evidence might have been a professional choice, not negligence, and applicants cannot always shift blame to their lawyers.

“This application is dismissed with costs to the respondent,” Justice Odongo ruled. He also ordered Kayondo and Mukasa to clear the bank’s legal fees.