Once upon a time in Kampala, Uganda there was a bank called Commercial Bank of Africa (CBA) and a company named Kare Distribution Ltd. They had done business together, involving loans and accounts, but things went sour.

In 2018, they ended up in a lower court to sort out their disagreement. Instead of fighting it out in a long trial, both sides talked and came to an agreement on how to settle the matter. The court approved this agreement and made it official, like a binding promise between them.

But soon after, Kare wasn’t happy with the deal. They thought there was a big mistake in the agreement that changed what they really meant. So, in late 2018, Kare went back to the same lower court and asked the judge to look at it again and cancel the agreement. The judge, after hearing both sides, said no—the agreement was clear, and there was no good reason to change it. This happened in August 2021, and the judge ruled in favour of CBA, telling Kare to stick with the original deal.

Kare didn’t give up. They decided to take the fight to a higher court, the Court of Appeal, hoping for a different outcome. They quickly filed papers to challenge the lower court’s decision, without checking if they needed special permission first.

You see, in Uganda’s judicial system, not every decision from a lower court can be challenged automatically in a higher one—especially when it’s about rethinking an agreement like this. The rules say you have to ask the lower court for approval to go higher, and you only have 14 days to do that after the decision.

Meanwhile, something else had changed. Back in 2020, CBA had gone through a big shift. It transferred all its business—loans, accounts, everything—to another bank called NC Bank Uganda Limited. With approval from Bank of Uganda, NC Bank changed its name to NCBA Bank Uganda Limited. So, CBA as a separate company stopped existing, but NCBA took over all its old responsibilities, including this dispute with Kare. NCBA even sent letters to the courts to let them know they were now handling these matters.

When Kare filed their challenge to the Court of Appeal, the bank (now acting through NCBA) stepped in. They said, “Wait a minute—this challenge shouldn’t even be here. Kare didn’t get the required permission from the lower court, and now the time limit has passed. It is like trying to board a bus after it’s already left the station.” They asked the higher court to cancel Kare’s challenge altogether.

Kare fought back. First, they argued that CBA no longer existed, so how could a “ghost” company complain? They showed papers from the 2019 board decision where NCBA took over CBA’s assets. “This whole request from the bank is invalid because they’re not a real company anymore,” Kare said. But as a backup, Kare admitted the permission slip-up was their lawyer’s honest mistake.

“Don’t punish us for that,” they pleaded. “We trusted our lawyer, and this challenge raises important questions that deserve a fair hearing. If needed, let us fix it now and move forward.”

The bank replied that the transfer was all legal and proper. NCBA had inherited everything from CBA, including the right to defend this case. A previous judge had already looked into this and confirmed that CBA could not act on its own anymore, but NCBA could step in. “We’re the ones really involved here,” the bank explained.

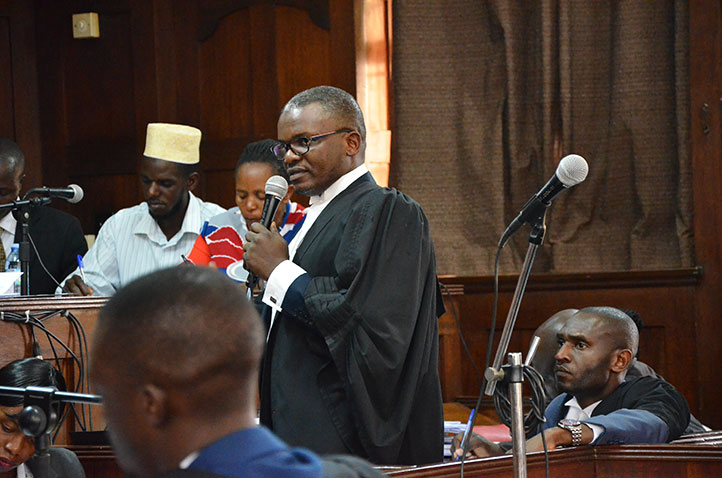

The Court of Appeal, made up of three judges, listened carefully. They thought about the main issue: agreements like the one between CBA and Kare are special. When both sides agree to settle, the court just stamps it—no deep judging involved. So, challenging it later is not straightforward; you can’t just jump to a higher court without following the steps.

The judges agreed that Kare missed a key step by not asking for permission right away. And since the 14-day window had closed long ago (from August 19, 2021, to September 2, 2021), it was too late to fix. They could not bend the rules just because it was a lawyer’s error or because Kare thought their case was strong. Rules are rules to keep things fair and orderly.

The judges also addressed the company name mix-up. They said NCBA was the rightful stand-in for CBA, as the transfer included all old business dealings, like the loan issues with Kare. So, the bank’s request was valid.

In the end, on September 3, 2025, the Court of Appeal sided with the bank. They canceled Kare’s challenge, saying it never should have started without permission. Kare had to pay the bank’s expenses for all this trouble.

It was a lesson in following procedures carefully—sometimes, skipping a step can end the whole journey before it begins.

This is a very informative article. Thank you as always!