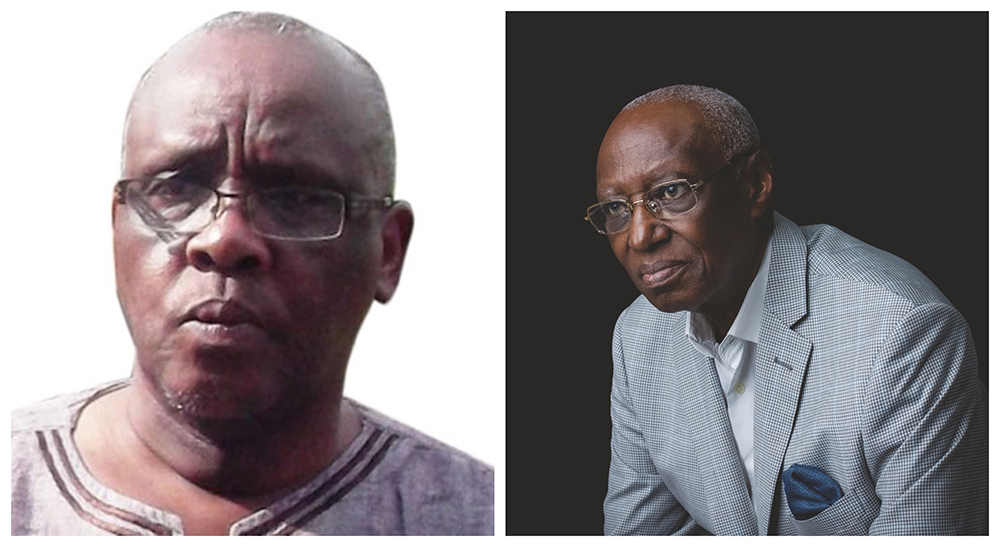

The High Court has ordered a special audit into the affairs of Incafex Limited, after one of its shareholders, former minister Mathew Rukikaire, accused other shareholders of sidelining him and mismanaging the company.

Rukikaire, the late James Garuga Musinguzi, and other shareholders started the company more than 35 years ago as a vehicle to carry out agricultural activities and other ventures.

Incafex owned ranches in Bulemezi, Buruli, and the Bunyoro and was widely involved in tea growing in the Kigezi subregion.

The dispute dates back to 2004 when Rukikaire petitioned the High Court, accusing Incafex of oppressing him as a shareholder.

Rukikaire told the court that he owned 45% of the company’s shares in trust for a foreign shareholder, Multiple Hauliers East Africa Limited, and that he had been excluded from management, denied access to company information, and shut out of annual general meetings.

Rukikaire accused Musinguzi and others of fraudulent sale of company ranches. Musinguzi died last year after a long battle with cancer.

In his petition, Rukikaire asked the court to end what he described as oppressive conduct, order an audit of the company’s accounts, and if need be, wind up the company.

In August 2008, the High Court ruled in his favour and ordered a special audit of Incafex’s affairs, noting that the company had been run informally and without proper records.

The audit was meant to determine whether the 45% foreign shareholding had been withdrawn and compensated, whether audited accounts and meetings were being held, and what steps were needed to restore good corporate governance.

However, other shareholders led by Musinguzi objected at the time. They appealed and won at the Court of Appeal in 2014. But in 2017, Rukikaire challenged that decision at the Supreme Court and won.

The Supreme Court reinstated the High Court’s earlier orders and agreed that Rukikaire was indeed a member of Incafex who had been oppressed.

The justices found that he had been denied notices of annual general meetings, which deprived him of the chance to protect his interests.

But the Supreme Court rejected Rukikaire’s prayer to wind up Incafex and instead said that the dispute should be resolved through a special audit.

Since then, the case has generated a series of applications, counter applications, and fresh suits, many of them aimed at stopping or delaying the audit.

Andrew Benon Kibuuka trapped as two ladies fight over ‘his land’

Fresh objections rejected

Last year, the High Court considered an application by Rukikaire asking the High Court to execute the Supreme Court decrees and bring the matter to closure.

Incafex opposed the application, arguing that the audit could not proceed because Rukikaire had failed to prove that he was authorised to represent Multiple Hauliers East Africa Limited.

Incafex claimed the High Court judgment had been obtained through fraud and cited a separate appeal still pending in the Court of Appeal.

This week, Justice Ginamia Melody Ngwatu, who heard the application dismissed Incafex’s arguments, describing them as delay tactics.

“I find that the objection raised by the respondent is a delaying tactic, which it already demonstrated through filing a fresh civil suit in the High Court to set aside a judgment that was reinstated by the Supreme Court,” she ruled.

She added that the pending appeal did not amount to an automatic stay of execution.

Who controls Incafex

Court records show that Incafex’s internal disputes have revolved around a small group of directors and shareholders.

The late Musinguzi was its founding chairman and a shareholder. Others include Agaba Maguru, who is listed as the company secretary and who swore affidavits on behalf of Incafex.

Rukikaire says he owns 45% of the company on behalf of Multiple Hauliers East Africa Limited.

Justice Ngwatu ordered that a special audit should be conducted within 60 days from February 2.

After the audit, final orders about the direction of the company will be issued. The audit is expected to determine whether the foreign shareholders were fully compensated, whether Rukikaire paid for his shares, and what remedies, if any, should follow.