Pearl Bank Uganda, formerly PostBank and Stanbic Bank Uganda, have partnered and integrated their digital wallets, Wendi and FlexiPay, to enhance financial inclusion across the country.

This collaboration, which prioritises cooperation over competition, will enable seamless transactions at reduced fees for over one million users of both platforms, making financial services more accessible and affordable.

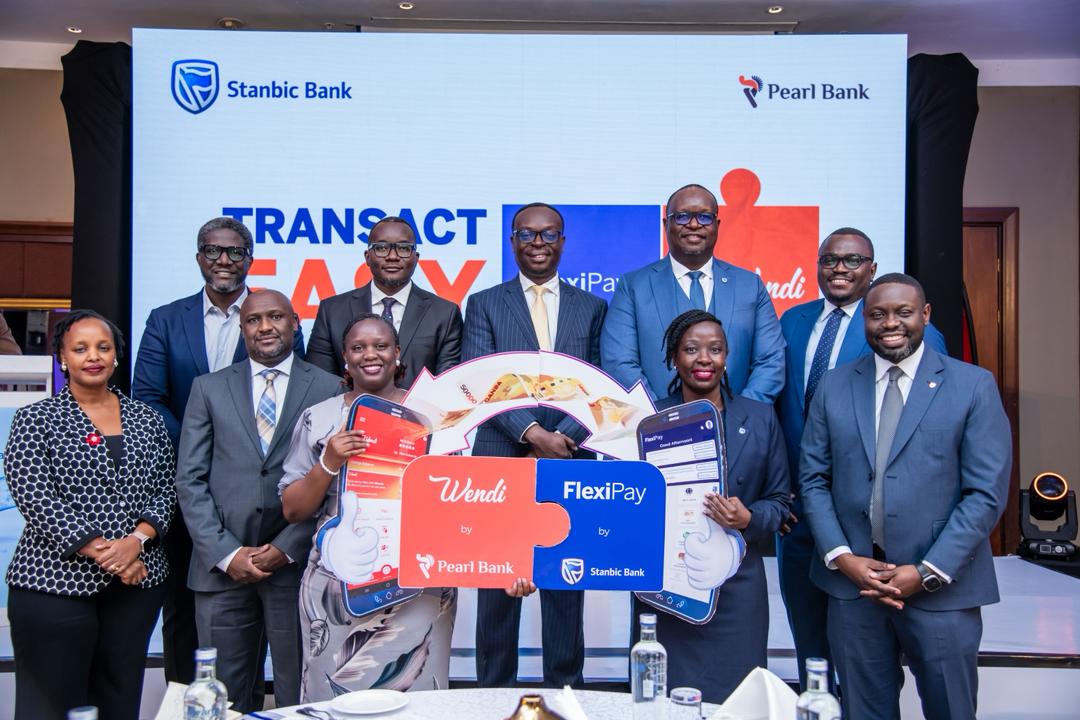

The announcement was made at a joint press briefing in Kampala, where both banks said the integration will allow users to send, receive, and pay effortlessly across the two platforms.

Mumba Kenneth Kalifungwa, chief executive of Stanbic Bank Uganda, sid the partnership is a victory for ordinary Ugandans.

“By connecting FlexiPay and Wendi, we are removing digital barriers, ensuring safe and affordable transactions for all, regardless of location or banking provider. It supports our focus on women, youth, and farmers under our Positive Impact pillar on financial inclusion,” he said.

Julius Kakeeto, Managing Director and CEO of Pearl Bank Uganda, said Wendi had been central to delivering government programmes for financial inclusion.

“With over one million customers and 8,000 agents, partnering with FlexiPay enhances convenience and access to a broader merchant and agent network. Wendi ensures Ugandans can transact and save securely, earning 10% annual interest on savings,” Kakeeto said.

Impact

FlexiPay, with its network of over 17,800 agents, serves more than 500,000 retail and merchant wallets and supports Stanbic’s successful SACCO programme. Wendi, meanwhile, has grown rapidly, facilitating government disbursements under the Parish Development Model and partnering with Western Union for international remittances directly into Wendi wallets.

The integration will roll out in phases, starting with joint awareness campaigns, shared agent support, and merchant onboarding in key agricultural and trading regions.

According to the National Financial Inclusion Strategy, access to formal financial services in Uganda has risen from 52% in 2013 to 68% in 2023, driven by digital innovation. However, many rural Ugandans, especially women, youth, and farmers, remain underserved. This partnership seeks to bridge that gap, promoting cashless transactions and fostering inclusive local economies.